Semiconductor Setback: AMD Disappointing Forecast Impacts Market Dynamics

Semiconductor stocks experienced a downturn on Wednesday following Advanced Micro Devices (AMD) less-than-stellar revenue forecast for the current quarter. The company is targeting a first-quarter revenue of $5.4 billion, with a margin of $300 million on either side, falling short of analysts’ $5.73 billion estimate. This announcement has raised concerns among investors about sluggish demand for non-AI chips.

AI Optimism Offset: Challenges for AMD Amidst Doubling Processor Projections

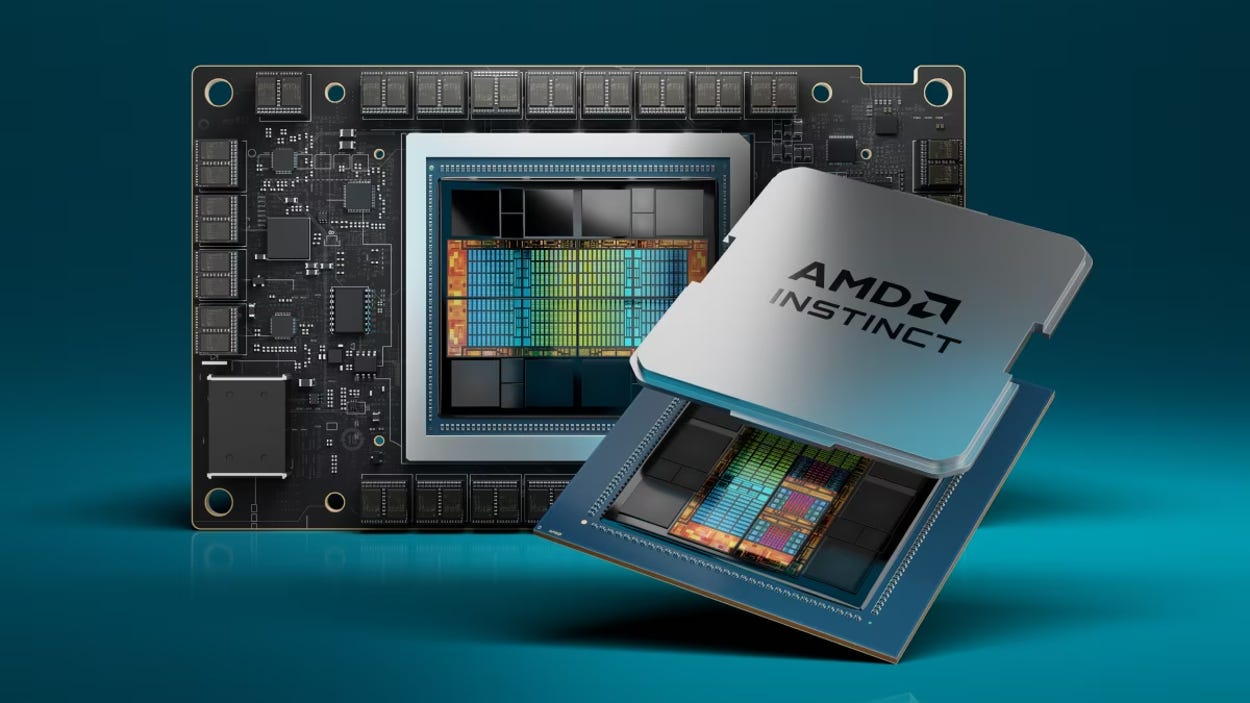

Despite nearly doubling its AI processor projections for 2024 to $3.5 billion, overall sentiment was impacted. Analyst Stacy Rasgon from Bernstein commented on the need to recalibrate expectations after the recent hype surrounding. Meeting the overly optimistic projections for datacenter GPUs in 2024 might pose a challenge, potentially pushing the stock into a more expensive territory.

On Wednesday, AMD’s shares, based in Santa Clara, California, saw a 5.5% decline to $162.75, affecting other semiconductor giants like Nvidia, Micron Technology, Qualcomm, Broadcom, and Intel. This decline was poised to wipe out approximately $60 billion in combined market value for these chipmakers.

The Philadelphia semiconductor index experienced a 1.7% drop after a 50% climb over the past 12 months. This setback for AMD follows Intel’s gloomy first-quarter revenue outlook, as the company grapples with catching up in the AI race and navigating a weak PC market.

CEO Lisa Su of AMD noted that demand from cloud computing companies remained lackluster, and a surplus in the automotive and industrial sectors weighed on the company’s programmable chips business. Furthermore, revenue from gaming segment contracted in the fourth quarter compared to the previous year.

Despite these challenges, at least five brokerages increased their price targets on AMD, resulting in a median price target of $190. This implies an expected 10.4% rise in shares over the next 12 months. The company’s price-to-earnings (PE) ratio stands at 43.87, the highest among major U.S. chipmakers. In contrast, Intel’s PE multiple is 29.78, Nvidia at 30.18, Qualcomm at 14.94, and Micron at 34.33. A lower PE multiple is generally considered indicative of a more attractive investment opportunity.

TD Cowen analysts acknowledged the lofty expectations set for AMD but emphasized that the company delivered where it counted. The market continues to navigate the dynamic landscape of semiconductor stocks, with AMD’s forecast contributing to the ongoing narrative.

Read More AI – Tech Foom