SoftBank Shift Towards Caution in AI Investments

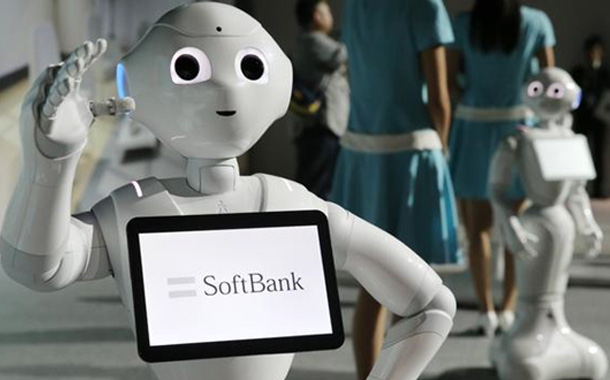

SoftBank Group, known for its bold investments in startups at peak valuations, is shifting gears towards a more cautious approach in its quest for the next big thing in AI. This change marks a significant departure from its previous strategy, which revolutionized tech investing with massive bets on startups.

The shift in approach reflects SoftBank’s defensive stance following a period of market volatility during the pandemic. Navneet Govil, CFO of SoftBank’s Vision Fund, emphasized the importance of prudence in their investment decisions, clarifying that they operate as financial investors rather than strategic ones.

In 2023, the Vision Fund made only 29 new and follow-on investments out of over 300 companies considered, signaling a more selective approach. The fourth quarter of 2023 saw a notable decline in investment activity compared to previous years, with SoftBank allocating $100 million, a stark contrast to the $20.9 billion spent in April-June 2021 alone.

Analysts like Mitsunobu Tsuruo from Citi commend SoftBank’s newfound strictness in selecting investees, attributing it to the challenging period the company endured. SoftBank recently reported its first profit in five quarters, with its Vision Fund business posting a $4 billion investment gain, leading to a substantial cash reserve of 4.4 trillion yen ($29 billion).

SoftBank’s focus on AI investments predates the success of chip design firm Arm, which it acquired a significant stake in and subsequently listed in New York. Yoshimitsu Goto, SoftBank’s CFO, emphasized Arm’s importance in the AI landscape, positioning it as integral to SoftBank’s ecosystem.

Looking ahead, SoftBank remains committed to investing in AI, targeting potential opportunities in hardware, infrastructure, and applications. Govil highlighted the early stages of AI’s growth trajectory, emphasizing the need for investees to demonstrate transformative qualities, innovation in AI, market fit, scalability, sound economics, and a track record of execution.

However, SoftBank’s track record in AI investments has been mixed, with many portfolio companies failing to see valuation growth despite the AI hype. Nevertheless, SoftBank’s history includes notable successes like Alibaba, Arm, and mobile internet technology, indicating potential for future gains in AI investments.

Despite past missteps, analysts like Tsuruo believe in SoftBank’s capacity for significant, controlling stake investments in AI, provided they maintain sufficient resources. While challenges persist in the competitive AI market, SoftBank’s strategic shift towards caution underscores its commitment to navigating these complexities in pursuit of sustainable growth.

Read More AI – Tech Foom